THE GLOBAL GAME: THREAT OR OPPORTUNITY?

WITH INTERNATIONAL BUSINESSES EYEING GAPS IN THE AUSTRALIAN MARKET, BEVERLEY JOHANSON UNPACKS THE QUESTION OF IMPORTS VERSUS LOCALLY MANUFACTURED PRODUCT. IS THERE A PLACE FOR BOTH? AND WHAT DOES IT MEAN FOR QUALITY AND CONSISTENCY OF SUPPLY?

While prefab has played a part in Australian construction since the earliest settlement, it has always been a cameo role. We have not had the impetus to bring construction indoors that drove colder, damper countries to find a more efficient way of building. We got used to hammering in nails at site and became reluctant to change.

With the drivers to adopt more widespread use of prefabrication – including the cost of hand-building on site and the subsequent expense of a long build – becoming more pressing, as they are all over the developed world, the need to be more efficient with materials and the quality offered by a closely monitored factory environment are expanding awareness of offsite methods.

Yet while the demand for buildings is high, despite the benefits offered by prefabrication, Australia is seen to be slow to fully embrace the technology; offsite construction comprises only about $4.5 billion of Australia’s $150 billion construction industry.

International players have not been so complacent about the opportunities to be had in Australia.

Amy Marks, president and owner of XSite Modular in the US and global thought leader on the prefab industry, says about Australia that “until there is true dissatisfaction on the part of the owners and the larger players in the indus-try, change will be slow. That dissatisfaction, a vision to enable prefabrication and concrete actionable steps to adapt the design and procurement processes are a must to overcome any remaining resistance in the industry. The industry wants change. The challenge is they may not understand how to change.”

“…until there is true dissatisfaction on the part of the owners and the larger players in the industry, change will be slow. That dissatisfaction, a vision to enable prefabrication and concrete actionable steps to adapt the design and procurement processes are a must to overcome any remaining resistance in the industry. The industry wants change. The challenge is they may not understand how to change.”

Amy Marks, president and owner of XSite Modular (US).

This, of course, leaves the way open for international prefab companies to increase their presence here. And some major players have made their way to our shores.

Chinese company CIMC Modular Systems has been building in Australia since 2008 and started with mining camps. The company’s emphasis has shifted to homes, multi-residential projects, commercial, education and aged care pro-jects.

Suker Yang, Business Development and Design Director for CIMC Modular Systems, says that the company is keen to expand further in Australia and sees potential in all of these areas. “Australia is the main CIMC market with the modular business,” he says. “Our first strength here is price, while experience is also very important.”

“The company’s modular systems are based on the container concept. The shell is steel while the internal decoration and finishes are not different to conventional construction,” says Yang.

“We not only have the solution with module supply, we can also provide funding to the developer.”

“We developed the modular building business in Australia mainly because CIMC’s modules are competitive with more construction cost saving, more quality control and also more program saving compared with traditional con-struction in Australia.”

CIMC Modular Building Systems operates globally and is part of China International Marine Containers, which pro-duces about 60 per cent of the world’s shipping containers and operates in numerous manufacturing, logistics, fi-nance and transport sectors with a share market capitalisation at June 2018 of $US5.8 billion.

China Wu Yi, considered to be a world-leading innovator in prefab and construction technologies, has partnered with Perth-based construction company, Doric Group Holdings to form Wu Yi Doric with the aim of bidding compet-itively on projects worth $100 million and above.

In 2012, Kyoto-based Sekisui House, a global builder with more than 2.3 million homes built, brought its Shawood home building system to Australia. The company has created masterplanned communities in NSW and Queensland.

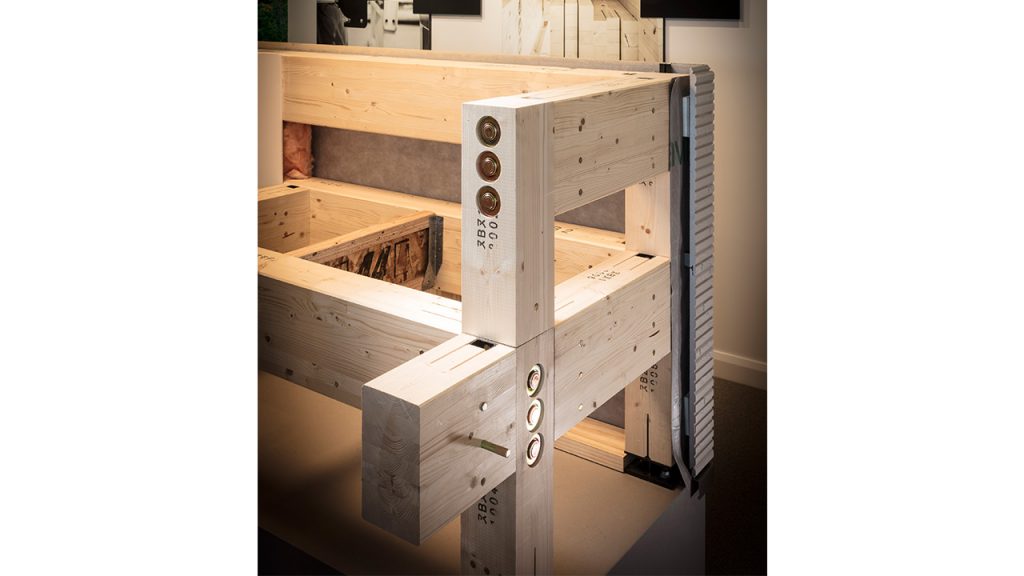

A core component of Sekisui Home’s Shawood design is eco-certified glulam structural timber from Finland. Proprietary metal joints and external nano hydrophilic coated cladding is imported from Japan and the majority of other products are locally sourced.

“We are constantly monitoring opportunities to increase the proportion of locally supplied materials and we naturally have a keen interest in glulam,” says Craig D’Costa, General Manager, The Hermitage, Shawood & NSW Home Building – Sekisui House.

“We developed the modular building business in Australia mainly because CIMC’s modules are competitive with more construction cost saving, more quality control and also more program saving compared with traditional con-struction in Australia.”

Suker Yang, Business Development + Design Director, CIMC Modular Systems.

“From the outset we have strived to design and construct our homes to a very high level of quality control and finish. This has been quite challenging in terms of instilling this outcome across our entire supply chain and trade base. Uniquely many of the early adopters are still with us after several years of operations here in Australia,” he says.

D’Costa says Sekisui House is optimistic about the potential to expand the Shawood system into mid-rise residential and mixed-use applications as well as expanding the housing communities to other regions.

James Marsden, Associate Director at TSA management, a company providing project services across a range of industries, spent some time studying offsite manufacturing in China and says the companies he visited were definitely in-terested in supplying the Australian market and keen for introductions. He believes that one of the main barriers to widespread prefab in Australia is that clients tend to be “quite conservative”.

“They haven’t really seen prefab en masse in Australia.”

There are issues in importing from China, he says. “Quality, compliance, logistics – and we need to work out where the risk allocation sits. There are also issues of offsite payment and insurance.”

“When bringing a project entirely from China, 80 per cent of the cost of the project is in the overseas manufacture and the shipping. We have to protect the client and their money,” he says.

Jacques De Bedout is General Manager for Design and Marketing at IBSI – Intelligent Building Systems International, a Queensland-based prefab construction company producing retirement villages, multi-storey modular student ac-commodation, hostels and schools.

IBSI imports materials and completed components from China and says that China is no longer cheap for smaller players. “It’s very competitive for large quantities, but Australia is a small fish,” he says.

One of the main issues with Chinese components, he says, is quality, particularly with the finish. “You always require an Australian-trained eye to finish a building,” he says, adding that IBSI is also looking at import possibilities from Sweden and Germany.

Everything used by IBSI is compliant with voluntary third-party building product certification scheme Codemark, he says.

“It’s healthy to look at what other countries are doing. It’s 100 per cent good for diversity in our industry. Singapore, for example, mandates a certain percentage of prefab in their construction. It’s a tiny country, but has done wonders moving into modular.”

“It’s healthy to look at what other countries are doing. It’s 100 per cent good for diversity in our industry. Singapore, for example, mandates a certain percentage of prefab in their construction. It’s a tiny country, but has done wonders moving into modular.”

Jacques De Bedout, General Manager – Design + Marketing, IBSI.

A key issue with imported products or homes is around quality and compliance with Australian standards, says Peter Mulherin, a research associate at RMIT and founder of ProductWise. ProductWise provides independent verification of product conformity. Mulherin has had a 30-year career in construction, design, manufacturing and project man-agement.

He says there is little certainty throughout the entire construction industry that materials and components comply with Australian standards. “And, there is nothing intrinsically different about prefab that would suggest they are vet-ted more rigorously than other products.”

Codemark is an important tool in this, he says, but it is static. “That product, on this day, meets expectations, but if things change then the Codemark may no longer be applicable. It needs to be updated.”

He cites fraud in certification, product substitution, products that don’t perform required functions and other issues of quality as being common throughout the traditional and prefab industries. Dimensional control issues are partic-ularly pertinent to modular building where plumbing and electrical connections don’t line up as they should.

The main challenge in solving these issues, he says, is that government sees it as a problem for industry to solve and industry says it’s a government issue.

ProductWise, in collaboration with RMIT and industry, is developing a system that makes it cheap and easy for suppliers and constructors to verify compliance with Australian standards. Mulherin says the system would be a world first with a global application. “It can provide a huge amount of efficiency for businesses challenged by the regulatory environment,” he says. “It creates incentives for all the stakeholders to demonstrate compliance and puts small manufacturers on a level playing field with large manufacturers.

“It’s a disruptive technology.”

According to Mulherin, much of the discussion and action around compliance issues in the building industry has been prompted by the Lacrosse apartment fire in Melbourne and the Grenfell Tower fire in London.

In the wake of these events, the Queensland Government introduced legislation that puts greater responsibility on all players in the supply chain to ensure compliance and broadened the powers of the Queensland Building and Con-struction Commission.

In Victoria, the VBA now has greater powers of entry to conduct inspections and gather evidence to monitor and en-force compliance.

The Minister for Planning Richard Wynne said “We’re bringing together the key agencies to better detect and address the issue of materials used in a non-compliant way.”

“The Commonwealth has to play a more active role too. We’ll keep pushing the Federal Government to better detect non-conforming products entering Australia.”

Brisbane-based prefab company Arkistruct cut ties with China after five and a half years and is now focusing on build-ing a Queensland manufacturing base. Arkistruct designed floor, wall and ceiling cassette panel systems in accord-ance with Australian standards and these were manufactured in Shenyang, China.

“We were like many small businesses that have supply chains abroad; it is often difficult to control costs and get the benefits of scale when you are trying to manage operations across two countries. For this reason we wanted to build our brand and our capability in Queensland before we reached further afield,” says Managing Director Daniel McGrath.

“We were like many small businesses that have supply chains abroad; it is often difficult to control costs and get the benefits of scale when you are trying to manage operations across two countries. For this reason we wanted to build our brand and our capability in Queensland before we reached further afield,”

Daniel McGrath, Managing Director, Arkistruct.

“We use steel famed panels, with the original version using magnesium oxide sheeting for the internal lining and ex-ternal cladding.

We ceased using MGO boards when we left China, and now use conventional FC sheeting on our pan-el systems. However, a key aspect of our product development is prototyping different cladding and internal lining materials,” he says.

“The response to Arkistruct moving all its manufacturing operations back to Queensland has been hugely positive. Not only from customers, but also from other industry participants such as trade suppliers, subcontractors, design and engineering consultants, and government,” he says.

“All our suppliers are now Australian, although some elements of these may have imported components.”

While Australia’s vast land mass, small population and remoteness from the rest of the world might necessitate some level of imported product, industry players indicate that quality and consistency of supply remain key challenges. With automation also enabling lower wages onshore, there are strong arguments from bringing production home.

Clearly however there is no room for complacency. ProductWise’s Peter Mulherin captures the need for action. He says that resistance to change is damaging for the industry. “Either you initiate change or have it imposed on you. If you don’t initiate change in an orderly manner, you will have foreign entities coming in and filling the void.”■