Real estate debt advisory specialist, Sirius Property Group, publishes data on savings using modular construction.

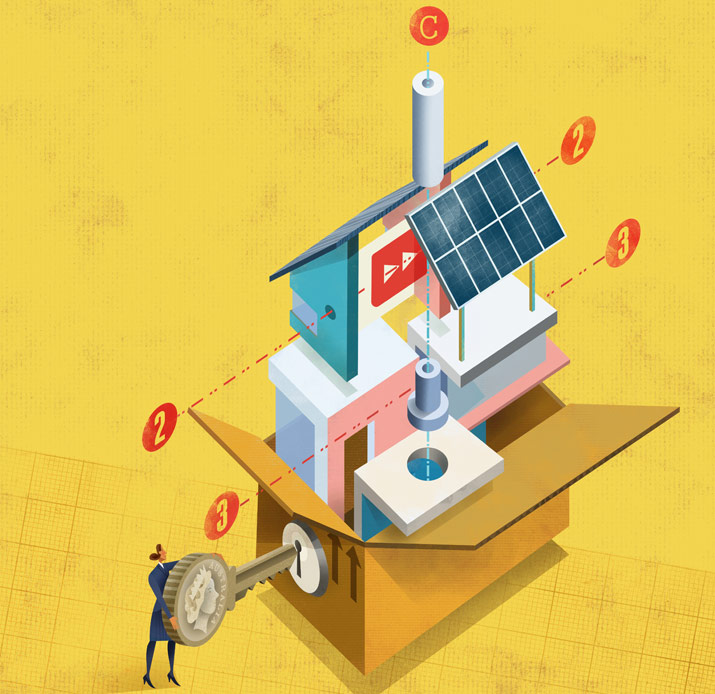

UK-based real estate debt advisory firm, Sirius Property Group, confirms that significant savings can be identified by building homes using modular construction rather than conventional onsite builds.

The data suggests that modular construction could save developers £126,000 ($232,000 AUD) more per development when factoring interest paid on the amount borrowed, because simply, they’re quicker to build.

On average, the estimated annual interest on development finance sits at approximately five per cent per annum, which equates to around 0.42 per cent per month.

On calculating the benefit on a loan amount of £5m ($9,200,000 AUD) over one year, property developers opting for an onsite build would see £252,000 ($464,500 AUD) paid in interest over just 12 months (modular construction savings).

However, developers using modular construction will have their construction completed 30 to 50 per cent more quickly than an onsite development.

Interestingly, by reducing construction time by 30 per cent, developers could see an interest saving of £75,600 ($139,000 AUD) in a single year, or £9,000 ($16,500 AUD) per month. And by reducing the time in half, the money saved reaches £126,000 ($232,000 AUD) per year or £21,000 ($38,700 AUD) per month.

“Modular builds provide a real opportunity for property developers to maximise their profit margins due to the significantly shorter build timeframes they provide,” said Nicholas Christofi, managing director of Sirius Property Finance.

“The quicker a project is completed, the sooner it can reach the market and generate the income required to repay any loans taken.

“With demand for housing higher than it’s ever been, developers are also under extreme pressure to deliver and this speed often results in homes reaching the market that aren’t quite up to standard.

“Modular building is the solution to these current problems, not only allowing homes to reach the market at a far quicker pace but also providing a far greater, more consistent level of quality control in the process.”

With the emergence of peer-to-peer lending property lending platforms, such as Assetz Capital, JustUs and CrowdProperty, accessibility for funding offsite construction of greener, sustainable housebuilding in the UK is now more prevalent.

Read Built Offsite finance feature here: builtoffsite.com.au/emag/issue-04/grappling-catch-22-financing-modular-builds

See: siriusfinance.co.uk

CLICK HERE to return to the home page for more articles.