Biden-Harris Administration increases mortgage availability for US prefabricated housing

The divide between those who can afford housing and those who can’t further entrenches all sorts of systemic disadvantage, and the long-standing gap between the supply of affordable homes for both renters and homeowners makes it harder for families to buy their first home and further drives up the cost of rent.

It’s a scenario that’s being played out globally, but the US Government has introduced measures that may, in part, address the issue.

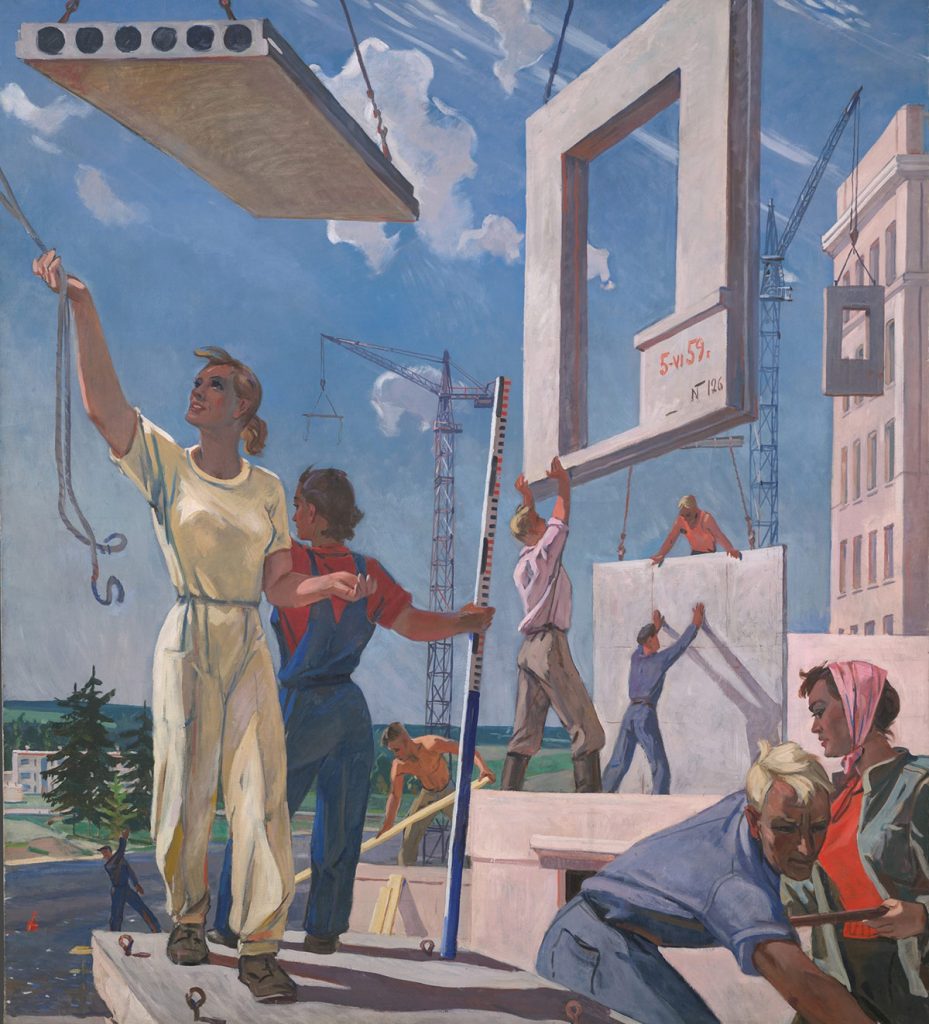

It’s a recognition of the role prefabricated housing can play in addressing the divide.

According to US Government figures, one out of every six homes purchased in the second quarter of 2021 was acquired by investors, and reports further indicate that in some markets, that number is one in four. Within investor purchases, typically more than 35 percent of purchases are made by investors that own more than ten properties.

The implications are clear: large investor purchases of single-family homes and conversion into rental properties speeds the transition of neighbourhoods from homeownership to rental and drives up home prices for lower cost homes, making it harder for aspiring first-time and first-generation home buyers, among others, to buy a home.

Last week the Biden-Harris Administration announced a number of steps that will create, preserve, and sell to homeowners and non-profits nearly 100,000 additional affordable homes for homeowners and renters over the next three years, with an emphasis on the lower and middle segments of the market.

It’s all about finance, and it’s a seismic shift in US Government policy as it now places equal mortgage ‘weight’ for prefabricated houses.

According to a US Government statement:

Making Financing More Available for Manufactured Housing: In 2020, FHFA authorized Fannie Mae to accept loan delivery on single-wide manufactured housing. An eligible single-wide, or single-section manufactured housing unit, is a factory-built rectangular structure placed on a permanent foundation and equivalent in quality and amenities to entry level stick-built housing. FHFA recently authorized Freddie Mac to accept eligible single-wide manufactured housing loan deliveries as well, which will make more financing available for such properties and facilitate the delivery of more manufactured homes. The Enterprises will continue performing industry-wide outreach and education about the eligibility of manufactured housing, modular, and factory-built homes. FHA also insures mortgages for single-wide manufactured homes that meet its programmatic requirements.

See: www.whitehouse.gov/briefing-room/statements-releases/

CLICK HERE to return to the home page for more articles.